Union Bank Savings Account Opening – Opening a saving bank account can be very tiring when you have to stand in long queues for submitting your KYC Documents for opening zero balance saving bank account in any bank branch . Also , you have to be dependent on the employees for issue of all documents including debit card, credit card , passbook , checkbook etc . To bring an alternative of this several banks after the Kotak 811 Full KYC Account service , several other banks have jumped into race of offering digital banking services to their customers thus reducing time and wastage of papers.

[lwptoc]

If you want to open your saving bank account online with zero balance , then in this article we shall be sharing you information on how you can open a digital saving account instantly at zero balance with Union bank of India with zero mab (minimum average balance ) option.

Why open zero balance account online ?

A zero balance saving account does not require you keep any amount in your bank account for lifetime and use it as a transacting tools with your friends , relatives or others . You can use a zero balance savings account to make or receive payments and their is no minimum average limit on these accounts .

Most of the bank institutions ask for their holders to maintain a minimum average balance in their savings account .This is due to keeping their accounts active until the holder himself applies for account closure or dormant . In case , this balance is not maintained the bank charges some penalty from the account holder for account opening or activating the bank account back .

Is their any difference in online account opening and branch account opening ?

Online saving account opening with zero balance is a balanced option of depositors who does not want to undertake long procedures of documentation to open a savings account in order to keep their own money . It is a facility with which users can create their own bank account with zero balance facility online without any verification from any agent or banking official and too in a prompt manner .

Offline saving account opening requires the account applicant to visit the bank and submit all documents for verification or opening of saving bank account in the bank .

Can you open Digital bank account with Union Bank Online ?

Union Bank through its Union Bank Online Zero Balance Account opening service is providing an option to those who want minimum effort in opening their bank account and need access to it on their mobile . With Union bank online zero balance account you can transact like any other saving account with unlimited options and facilities .

Union bank is a government owned bank and is controlled by the Reserve bank of India . The saving account opened online with Union bank can be operated through the official Union bank mobile app – Vyom .

How to open Union Bank Zero Balance Savings Account Online ?

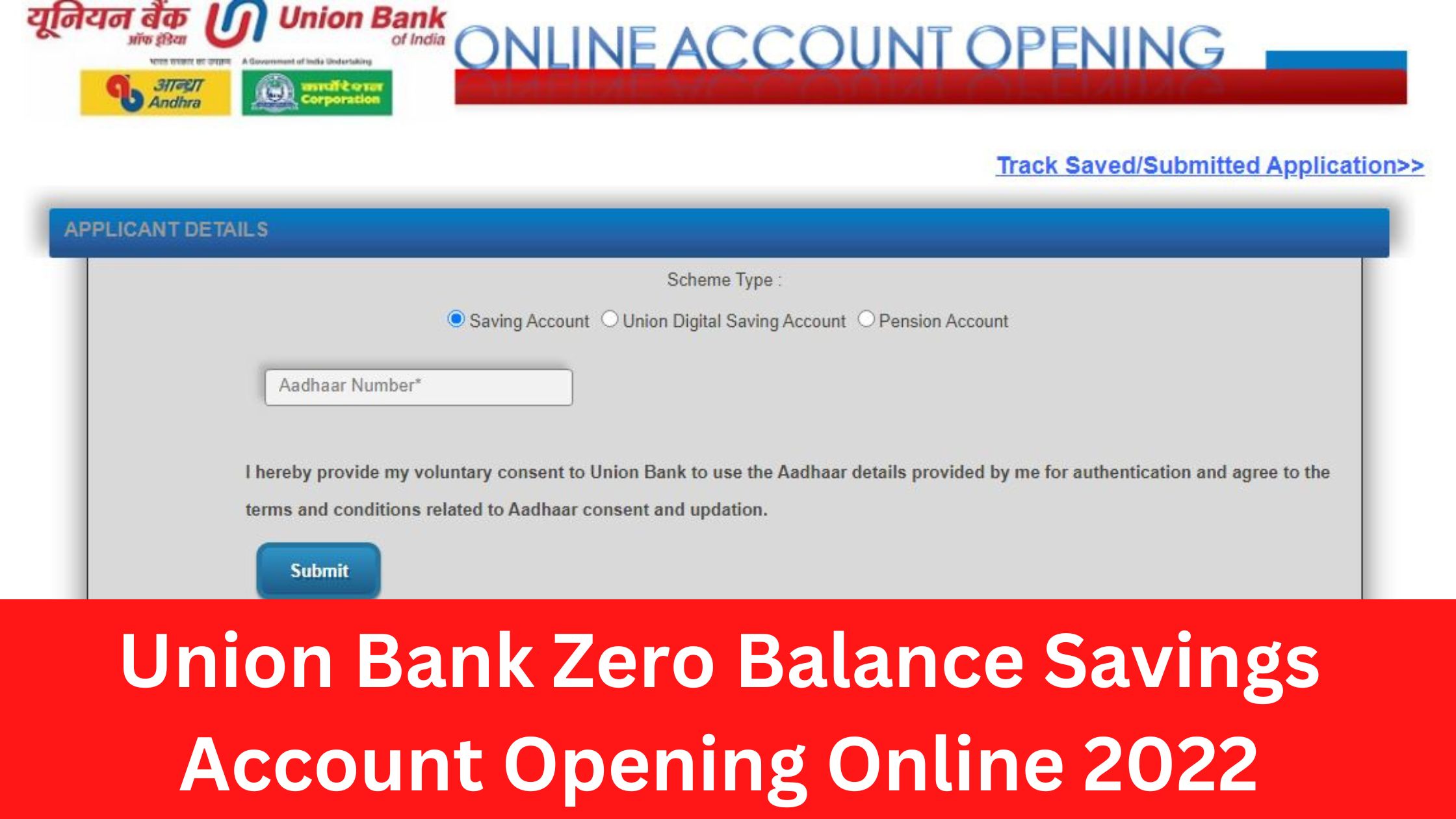

To open Union Bank Zero Balance Saving Account online you can follow the below process :

- Go to official web portal of Union Bank Online .

- Enter you KYC Details and Address details.

- Upload all your documents

- Submit the Application .

Once the reference ID is generated , you have to visit the nearby Union bank branch for one time OTP Verification . Once the account is verified , you can obtain all you documents like Passbook , Checkbook and Debit card from the bank itself .

Documents for Union Bank Online Zero Balance Saving Account opening online ?

To open a digital Union Bank Online Zero Balance Saving Account you need the following documents :

- Aadhaar Card

- PAN Card

- Passport Size Photograph – 20 to 100 KB

- Identity Proofs – 20kb to 100 Kb

- Signature proof – 20 kb to 50 kb

Zero balance account opening with Union bank is easy . You doesn’t require any major documentation or formalities to complete to open a savings account with Union bank . If you need assistance regarding loan or bank account opening online . You can share us your feedback down in the comment section below .