Finding a good stock or a mutual fund product to invest your hard earned money could be difficult because choosing any mutual fund SIP or any stock based on their last 3 year profits , profit earning ratio or CAGR could be only a limited concept to choose any investment option . People tend to prefer FIXED deposits and investment securities in Gold bonds or Post office in order to earn limited returns like upto 7% on their investments but this could not be possible in stock market because their is huge risk involved. Also , paying huge amount to market analyst for earning them good returns is also difficult.

If you do not want to keep your money liquid along with making it returns of more than 7% P.A then , in this article we have discussed about how you can use a tool advisorkhoj to analyse different stocks and mutual funds in real time to choose the best investment for your money.

[lwptoc]

Advisorkhoj Analysis tool for Mutual fund

Advisorkhoj provides you a complete solution for anlysing your new or existing mutual fund portfolio. The company manages different research reports to provide to investors based on the risk and returns expected and which could be realised in real market from such markets based on the reports .

The analyst on the Advisorkhoj are all market researchers and analyst which provides calls , reports and on call client support in knowing where to invest and how much to invest to get good returns in a year. Mostly, the company handles mutual fund portfolios and also the stocks which are booming in results.

What to check in a Mutual fund before Investing ?

Mutual funds are simple investments which does not guarantee results in profits only but they are highly expected for returns more than fixed deposits . Mutual funds are managed by fund managers which charge for their service and receive public money to invest in securities to receive returns .

Generally people check for last 3 year returns and performance of the fund and the changing fund managers of the fund . The proficiency of the return to give returns more than the inflation rate and the average return provided by any investment.

Few things which are essential to be checked before investing in any mutual fund involve :

- The current NAV of the mutual fund compared with the last year NAV of the same month .

- The stocks holding of mutual fund product .

- The exit charges of the mutual fund product .

- The average cagr of last 3 years.

How AdvisorKhoj helps you in analyzing a Mutual fund ?

Advisorkhoj is all about mutual funds and recent developments in the mutual fund industry . If you want to check any legal changes , regulatory changes by government related to mutual fund investments , best performing mutual funds in 2022 , 2023 or future expected returns or picks by experts all is explained by Advisorkhoj Online .

Also read :

- Online Equity Intraday Trading Kaise Sikhe – Open Interest & Investment

- Bank Nifty or Nifty Trading me Online Share Market Indicators Kaise Use Kare

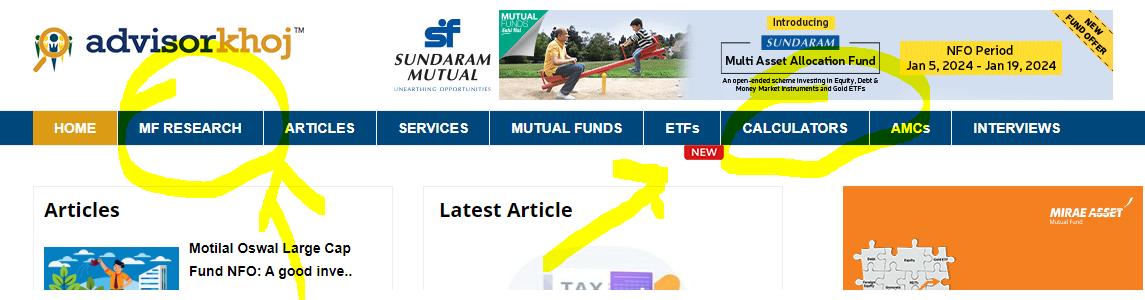

What you can do with AdvisorKhoj for your Mutual fund analysis ?

Going on Advisorkhoj , you can go to MF Research section and opt for more than 50+ tools to analyse you current mutual fund portfolio performance and future expectations . Also , you can receive email alerts on your preferred MF investment picks from the platform for free.

The website entirely works on providing the best opted mutual fund products and also being a mutual fund advisor you can become a part of the network to promote your services or promote your business with the platform .

Is reports manipulated on AdvisorKhoj or not ?

Reports as the actual performance of the mutual fund product happens could not be manipulated but if the platform requires you to purchase a certain product , there could be some articles or attractions which can attract you towards a particular mutual fund product .

It totally depends on you to choose a particular mutual fund portfolio to invest and to take the service of Advisorkhoj or not.

Can you compare Mutual funds and performance on AdvisorKhoj Platform ?

Yes , there are multiple parameters according to which you can compare , analyse or research on a particular mutual fund product . Also , for your personal investments you can prefer the platform advice and articles before investing in any particular mutual fund scheme 2024.

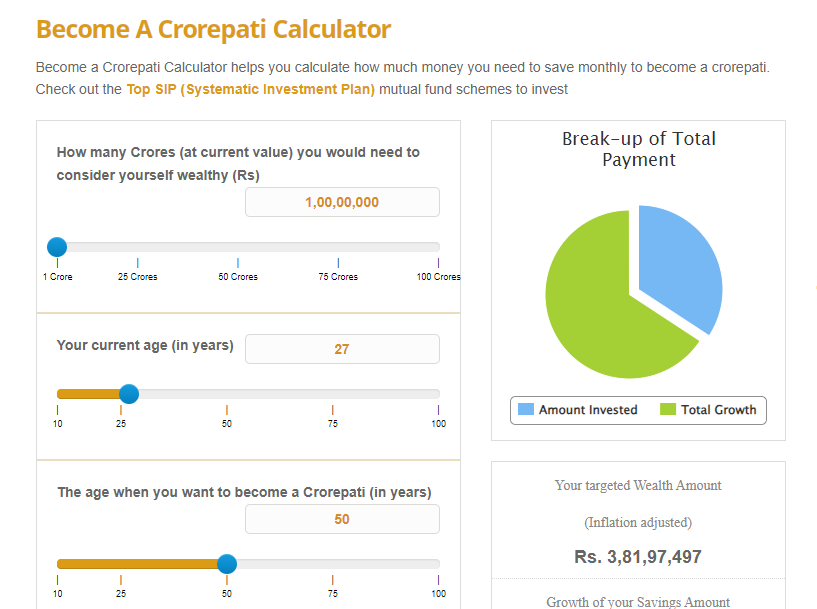

Popular Mutual Fund Calculators by AdvisorKhoj in India

Popular mutual fund calculators provided by Advisorkhoj :

- SIP Return Calculator – AMC / NON AMC Wise .

- LUMSUMP Return Calculator

- STP Return Calculator.

- Loan EMI Calculator

- Compounding Calculator

- Spending Less Calculator

- Future Value Inflation Calculator

- Human Life Value Calculator

- Lumpsum Target Calculator

- Lumpsum Calculator

- Children Education Planner

- Networth Calculator

- Become A Crorepati

- Systematic Investment Plan Calculator

- Mutual Fund Sip Calculator Step Up

- Goal based Top Up SIP

- Target Amount SIP Calculator

- Other Calculators :

- SIP with Annual Increase

- Public Provident Fund (PPF) Calculator

- Employees Provident Fund Calculator

- Tax Calculator

- Retirement Planning Calculator

- Asset Allocation

- Home Loan EMI Calculator

- Personal Loan EMI Calculator

- Car Loan EMI Calculator

- Education Loan EMI Calculator

- Goal Setting Calculator

- Composite Financial Goal Planner

- Cost Inflation Index

Also read :

Can you invest on advisory of AdvisorKhoj ?

No , their is no such service provided by Advisorkhoj rather you can opt for the consultation service of the experts associated with ADVISORKHOJ.COM

Note : This is not a sponsored post neither we are promoting any particular Advisorkhoj . If you want help related to mutual funds you can consult the Advisorkhoj team.