Kredito24 Loan App – Kredito24 Loan app is a platform available to avail personal loan in easy steps . There are multiple platforms online with which you can apply for a personal loan or a small app based loan which can be repaid within an interval of 30 days or less. While it can be said that such apps which provide short term loans could be harassing but some apps in India providing loans does work legitly providing loans on lower rate of interest and without much complications .

Kredito24 loan app basic concept is to provide instant loan to their customers for their small credit needs. What is this loan application all about and how you can apply loan online with KREDITO24 loan app is what we have discussed in this article.

[lwptoc]

Kredito24 Loan App

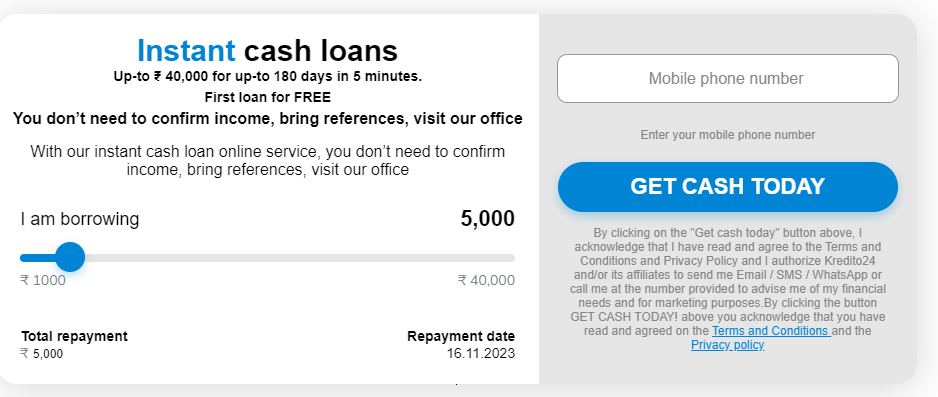

Obtaining a loan from Kredito24 loan app is easy as you can apply for any loan amount within Rs 1000 to Rs 10000 per month from the application . Personal loan obtained from Kredito24 loan app can be repaid within a period of 7 days or 28 days while the app issues the loan amount directly to the bank account of the applicant .

Application of personal loan through Kredito24 loan app can be done online by registering on their portal or by downloading the Kredito24 loan app . Once applied ,after confirmation for the loan agreement the loan is disbursed directly to the bank account of applicant .

Kredito24 Loan Legit or Not

Kredito24 is a legit company providing short term credits and loans to its customers . The company offers loans through a registered RBI Company Financial Services Pvt ltd and GSD Trading which provides short term loans . Kredito24 works as a mediatory and a medium to the customer for applying loans through the NBFC for tracking.

Kredito24 is a legit platform to apply for personal loan which can be repaid within time of 28 days or less. The interest charged by the company is as low as 0.2% or even 0 percent per day basis. For delay in repayment or overdraft the company might charge for about 0.2% on per day basis.

How to apply for Kredito24 Personal Loan ?

You can apply for a personal loan from Kredito24 loan app through following procedure :

1. Go to Kredito24 Loan App official website .

2. Enter the amount to borrow .

3. Complete the form for application

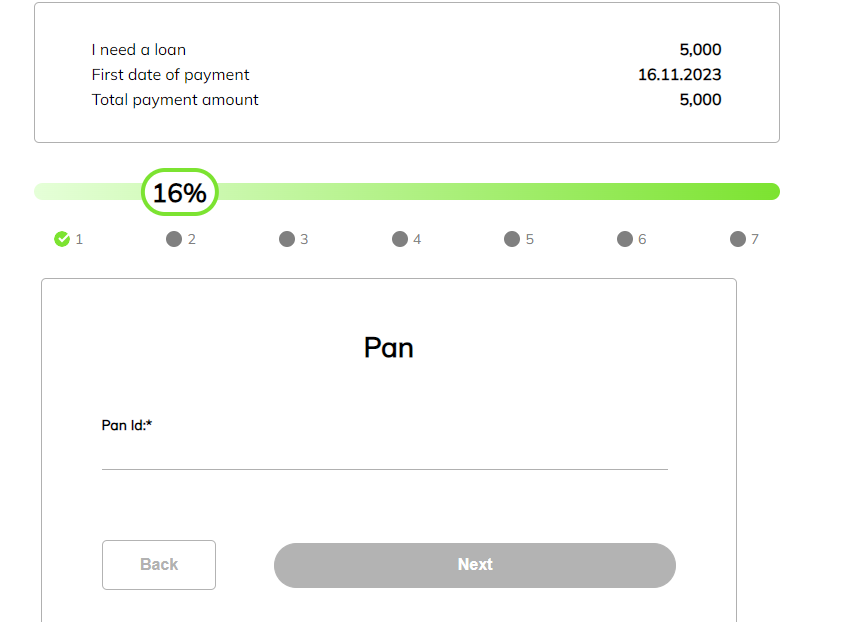

4. VERIFY PAN and Mobile Number for application .

After submission of details , you can confirm for the loan application and the loan amount is disbursed onto your account .

Also read : CSC Gas Agency Business Online in India Earn Rs 50000 Per Month in Bihar with Gas Agency Distributor

Documents for Loan on Kredito24 Personal Loan

Documents required for applying loan through Kredito24 Loan app include :

- Aadhaar Details .

- PAN Card Details .

- Address Proof.

- Income Proof.

- Digital Signature for Agreement .

How repayment of loan is done on Kredito24 ?

Repayment for the loan can be done on Kredito24 app in a single instalment or on daily basis for a maximum period of 28 days. The loan is provided for a maximum period of 28 days and for a maximum amount of Rs 40000 only to trusted parties.

Hope , now you can fullfil all your personal loan needs with Kredito24 loan app with the above details . If you have any queries you can share with us down in the comment section below.