Bajaj Finance Home Loan is an easy solution for all those who are seeking to buy their own house in 2023.While most of the loan houses offer loans for a minimum period or on a higher interest for longer period , people tend to look for options to get the most highest amount of loan for buying a house or for construction of their existing property. Bajaj finance loan for home can be availed directly from any bajaj finance home loan branch nearby your area.

If you are looking for application of home loan from Bajaj finance and want to know how you can apply for a home loan for yourself or what is the eligibility for home loan for Bajaj finance all has been discussed in this article below.

[lwptoc]

Bajaj Finance Home Loan 2024

Bajaj finance home loan can be availed for a maximum period of 40 to 45 years from Bajaj finance . The proposed rate for home loan in bajaj finance in 2023 is 8.45 percent and it can be applied to buy a new house or for construction of an existing property.

Home loans from Bajaj finance requires proper documentation and discussion on home loan agreement with the company before loan disbursal . You can easily apply for home loan for construction from bajaj finance also online on the official website of bajajhousingfinance.in.

Bajaj Finance Home Loan Application Online without Agent

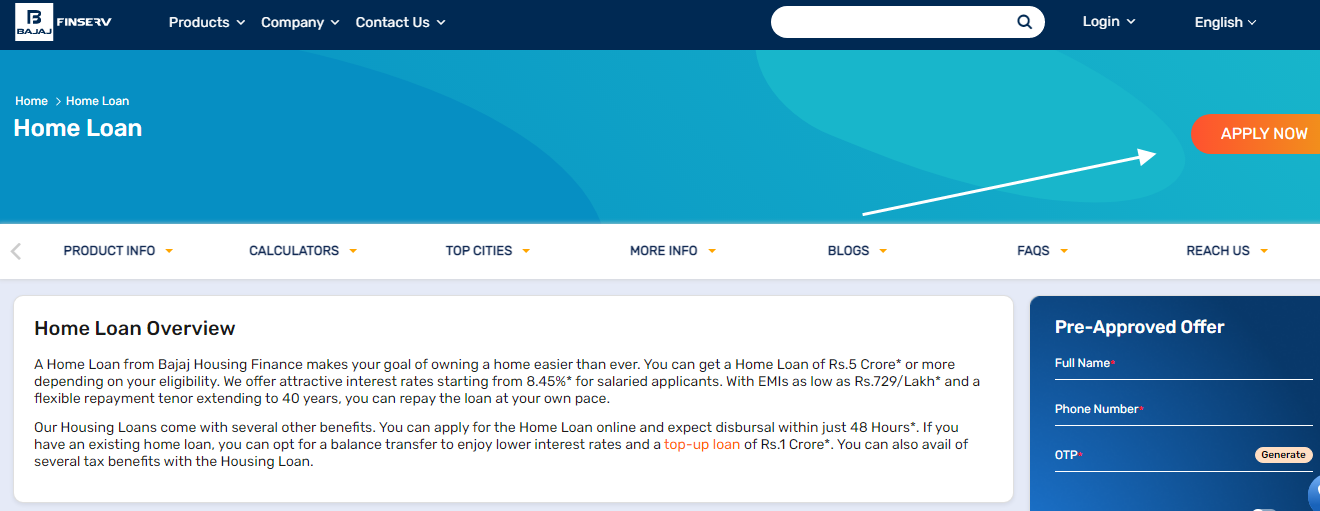

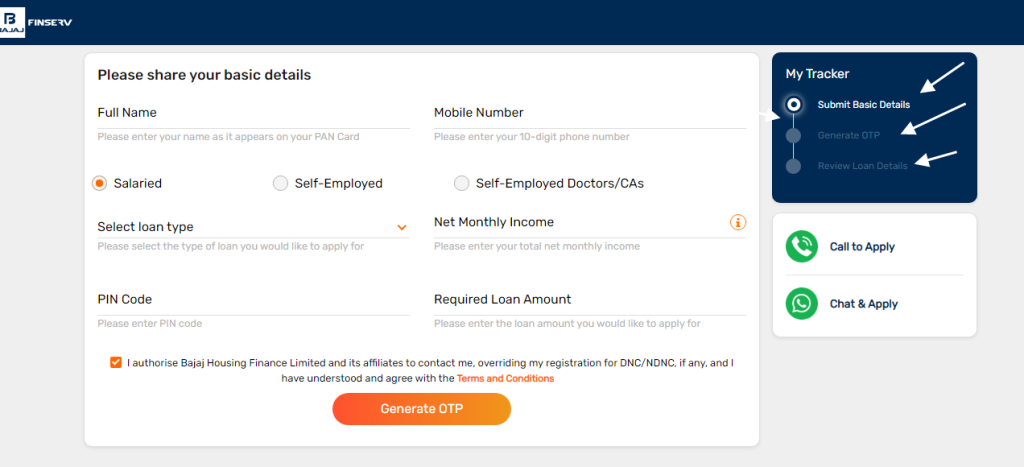

Bajaj finance offers loan application for home without help of any agent where you can straightaway apply for loan checking the application online . For application of home loan from Bajaj finance , you can check the following procedure :

Go to Bajaj Finance Home Loan Application Page .

Click on Apply now .

Fill in all the details .

Click Submit .

Once the form is submitted , you will receive a callback from the bajaj loan support for processing your loan request further and will inform you for the disbursal and EMI process.

Bajaj Finance Home Loan Eligibility

Home loan eligibility from Bajaj finance depends on the past credit history and financial status of a person and the property to be bought or constructed . Based on the below eligibility , you can apply for a home loan from bajaj finance :

- You must be above the age of 25.

- You must be hold Income tax returns of past 5 years.

- Salaried employee with working experience of 3 year in any reputed company with Salary slips of above 3 years .

- Must be an Indian resident

- Should be holding a bank account .

Bajaj Finance Home Loan Documents

For application of home loan from Bajaj finance , you shall be requiring the following documents :

- KYC Documents of Applicant – Aadhaar and Pan card details

- Current address proof or rent agreement

- Income proof – ITR Income tax returns of last 5 years or Salary Slips of last 3 years.

- Business Proof

- Account Statements

- Proof of Age.

- Property Documents

How much time for Bajaj Finance Home Loan Processing ?

Home loan processing from Bajaj finance could take around a processing time of 10 to 15 days . In some cases , loan for a shorter duration or for a lower amount below Rs 20 lakh shall be issued within a week to the applicant after processing .

What is LTV , FOIR and Credit Score Demand in Bajaj Finance Home Loan ?

Bajaj finance considers few values while permitting home loan to an applicant . For application of home loan :

- LTV – Loan to Value ratio shall be considered where a property of 30 lakh shall be granted loan upto 90% amount and this LTV could be as low as 75% for a value of property which is above 75 lakh .

- FOIR – Fixed Income to Repayment Ratio considering the Salary Slip or ITR of the applicant loan EMI is decided based on the earnings of the applicant . For which EMI is decided for a very low amount on the Salary or monthly income of the applicant .

- Credit Score – The credit score provided by CRISIL for a loan applicant shall have to be more than 750 shall be easily granted a home loan .

What is Bajaj Finance Home Loan Closure Process ?

For home loan closure with bajaj finance , their are easy options for a applicant of home before the tenure or after completion of EMI tenure of loan with Bajaj finance :

- By repayment of balance payments at lower interest in one go.

- By repayment of all EMI and requesting for closure document from the company .

For closure of home loan with Bajaj finance you can check the customer portal or branch locator option on the website to check your loan status and the nearest bajaj finance branch for the closure of the loan .

Which is better Bajaj Finance Home Loan Foreclore or Complete Loan Payment ?

Foreclosure of Bajaj finance is an option for the home loan applicant to close his loan for home with Bajaj finance before its tenure . It can be done by repayment of the balance amount to the bank at lower interest rate or foreclosure amount provided by bank.

It is better if you can foreclose your loan account with the bank before as you will be saved of the interest charges. While if you are a high tax assess , for emi payments , you can claim for savings of taxes on your home loan interest if you pay the entire loan in EMI.

Also read : Axis Bank Vistara Credit Card Free Lounge Access – Amazing Deals with Axis Vistara Premium 2024

Bajaj Finance Home Loan Floating Rate Vs Fixed Rate on EMI

Bajaj finance home loan are provided on both options floating rates and Fixed rates . Both have different options where :

- Floating rate home loan by Bajaj finance – The bank offers loan on increasing or decreasing rate where the EMI does not increase but the EMI period of person increase with increase or decrease in Repo rates of RBI.

- Fixed rate home loan by Bajaj Finance – The bank offers home loan on fixed rate where the EMI and period remains same even if their is a decline in interest rates.

How to obtain Bajaj finance home loan schedule for EMI ?

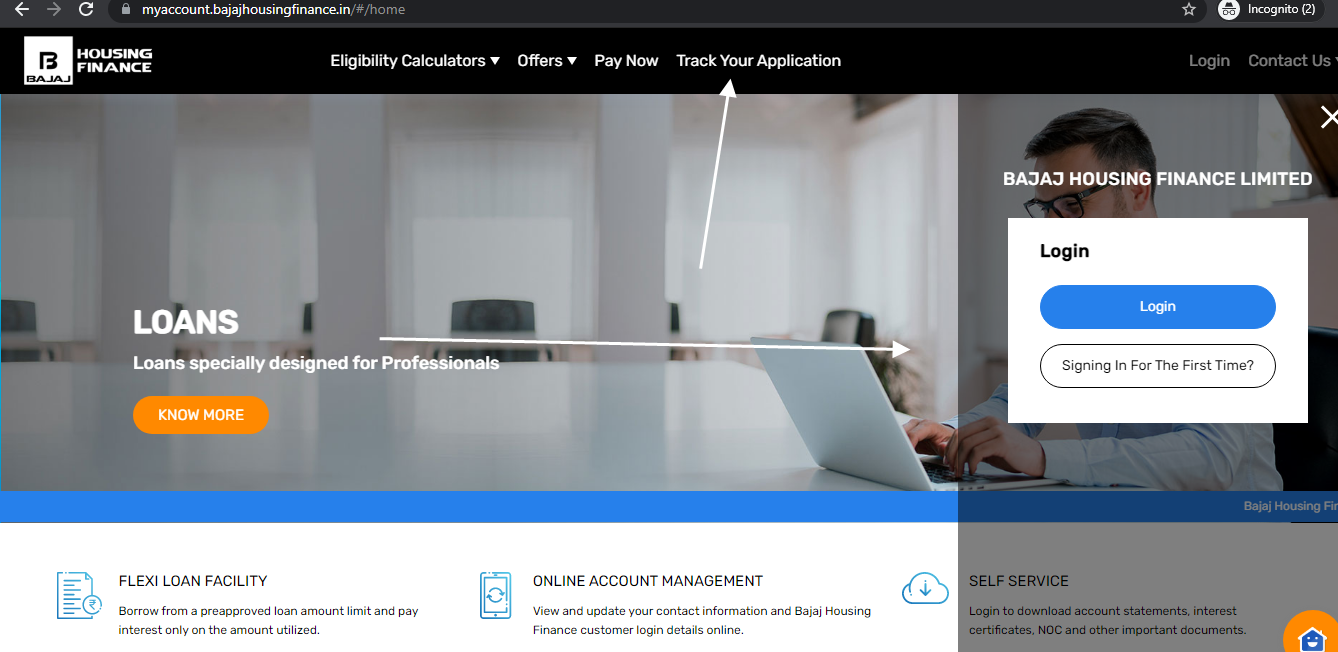

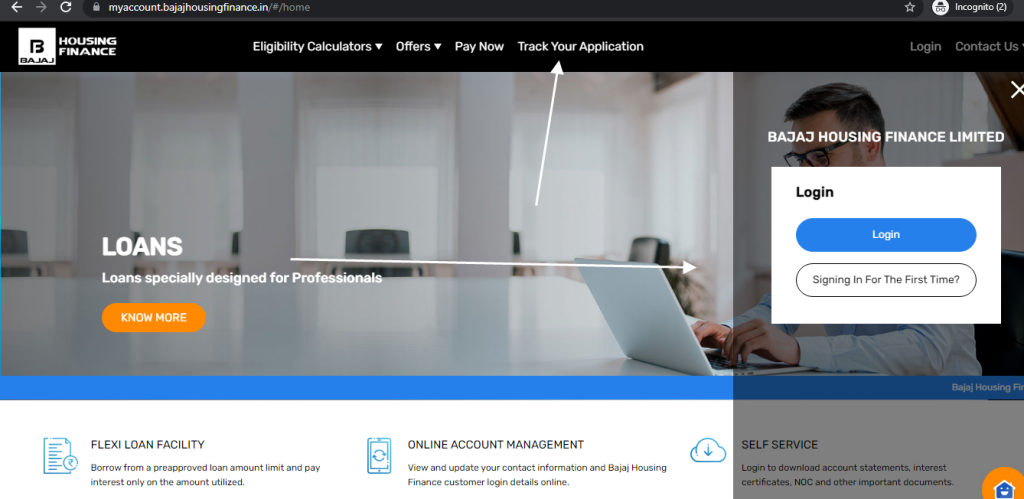

To get your home loan schedule for Bajaj finance home loan application online , you can follow the process :

- Go to customer portal of Bajaj finance for home loan .

- Click on Login or Sign in for First time .

- Enter your Mobile Number and OTP Registered at the time of loan .

- Click on Track your Application or Check your Current Loan Status Option to know about your loan .

With this you can instantly check for the schedule of Bajaj finance home loan online without moving out of your home .

Also read : IDFC WOW Credit Card Apply 2024 – Best Credit Card for Students in 2024

Bajaj Finance Home Loan EMI Bounce Problems

Bajaj finance home loan provides for several penalties on the home loan applicant for not paying of his EMI timely . Also , there are linked processing and EMI bounce charges charged by the company in case EMIs are not paid on time .

EMI Bounce charges on Bajaj finance home loan varies depending on the amount of loan where the loan amount lower than 15 lakh Rs 500 be taken at every EMI bounce charges , other EMI bounce charges on Bajaj finance home loan include :

| Loan Amount (in Rs.) | Charges (in Rs.) |

|---|---|

| Up to Rs. 15 Lakh | 500 |

| 15,00,001 – 30,00,000 | 1,000 |

| 30,00,001 – 50,00,000 | 1,500 |

| 50,00,001 – 1,00,00,000 | 2,000 |

| 1,00,00,001 – 5,00,00,000 | 3,000 |

| 5,00,00,001 – 10,00,00,000 | 5,000 |

| More than 10 Crore | 10,000 |

What is Bajaj Finance Home Loan Disbursal ?

Bajaj finance home loan disbursal is a process where an applicant has an option to takeaway the entire loan amount in a single go from the bank or can takeaway the loan amount at intervals from the company . In such cases interest rates and EMI values shall vary.

Bajaj Finance Home Loan Charges

On the home loan charges on bajaj finance , the following charges shall become applicable on your loan scheme :

| Fee | Charge Applicable |

|---|---|

| Processing Fee | Up to 7% of the loan amount + GST as applicable |

| EMI Bounce Charges | Up to Rs.10,000* (refer to the table provided below for the full break-up) |

| Penal Interest | 24% per annum in addition to the applicable interest rate on the overdue amount |

| Secure Fee | Up to Rs. 9,999 (one time) |

Bajaj Finance Home Loan Tracker Online

If you want to track your bajaj finance loan for home online , you can track the loan application :

- Go to Bajaj Finance Customer Portal .

- Click on Track your Application Online .

- Enter your Application ID or PAN Number or Mobile Number to check your Loan Application status.

Once you enter the details , your loan application as accepted or rejected shall be shown on the screen.

Bajaj Finance Home Loan Interest in 2024

The home loan interest from Bajaj finance varies from as low as 8.45% p.a to 12% p.a depending on the loan amount the risk involved in financing a property. The actual loan interest applicable , shall be shown to you by the bank in your loan application statement online .

Bajaj Finance Loan for Home Calculator Online

To check your Bajaj finance home loan calculation online based on your home , you can check the home loan calculator of Bajaj finance online .

Application of Topup on Home Loan from Bajaj Finance in India

In case , the loan amount seems limited you can also apply for home loan topup for your existing home loan with additional amount from the company . The loan will be disbursed,according to repayment of the existing home loan with bank.

Also read : The Money Club @moneyclubber.com – Online get Rs 50000 per month with Rs 1000 investment

Hope , for applying for home loan with Bajaj finance you can take help of the above content. If you have any queries , related to this you can comment down in the comment section below.